The Federalists Reloaded | No. 11

The Succession of States: Hamilton vs. the Dysfunctional Republic

Let’s get one thing out of the way: the original American states weren’t exactly team players. In the 1780s, each state was acting like it ran the whole show, negotiating trade, taxing imports, and cutting side deals like it was gunning for a hostile takeover.

Sound familiar? Think of Succession. Imagine the thirteen original states as the Roy kids, each one trying to run their own little fiefdom, more interested in control than competence. Now picture Alexander Hamilton as Logan Roy, walking into the room, reading the chaos, and saying what needed to be said:

That’s Federalist No. 11.

Published November 23, 1787, Hamilton’s essay isn’t lofty or sentimental. It’s pragmatic and unapologetically capitalist. He sees America’s economic survival as depending on unity, not just in government, but also in how it trades, negotiates, and defends its markets. He doesn’t want the federal government regulating every industry. He wants it coordinating policy so the United States can compete on the world stage.

“A unity of commercial regulations will produce more wealth, more revenue, and more power.”

This wasn’t about command economies or top-down planning. It was about stopping thirteen states from tripping over each other while foreign nations pulled the strings. If the U.S. wanted economic independence, it needed to act like one nation, not a collection of small businesses squabbling over customs duties.

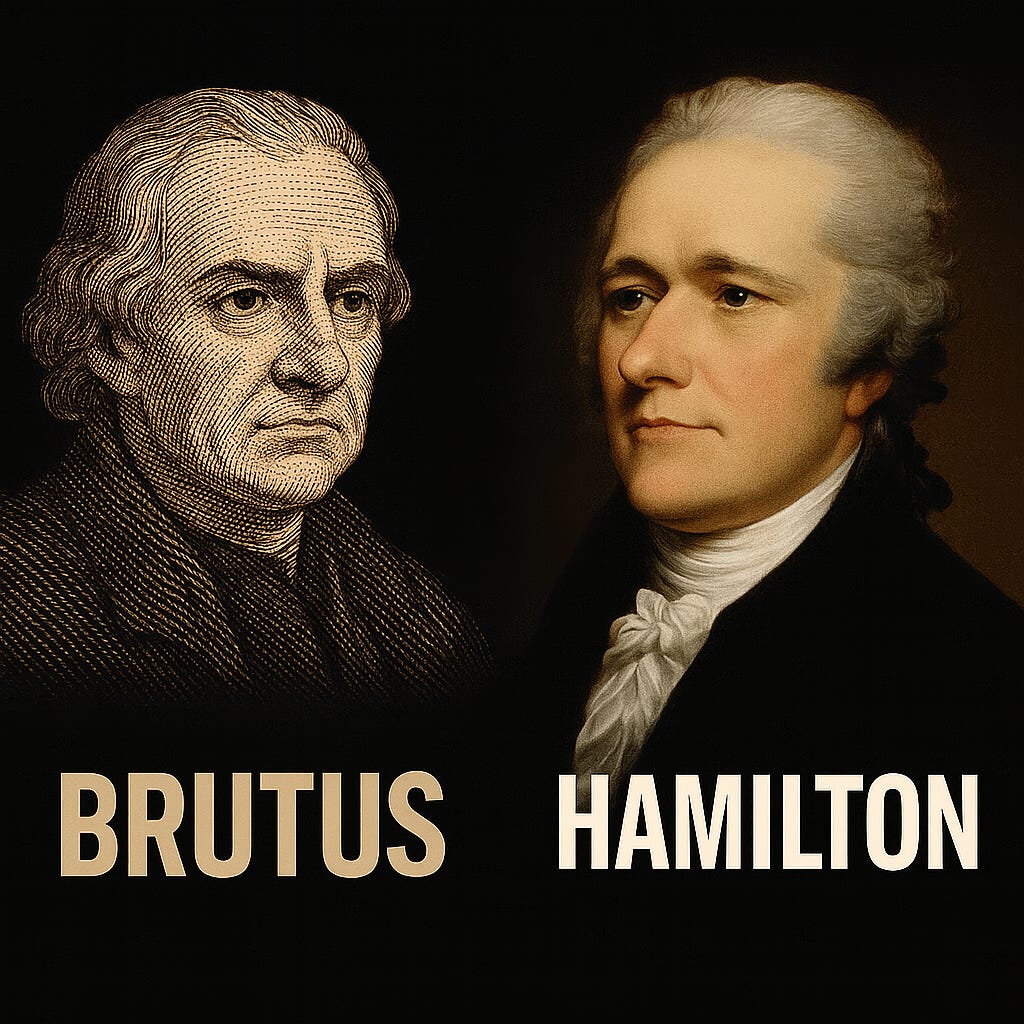

But Hamilton wasn’t without critics. The Anti-Federalists were not interested in giving the central government more levers to pull. And they didn’t buy that economic unity wouldn’t eventually morph into political consolidation and cronyism. Brutus warned early and often:

“It is a truth confirmed by the unerring voice of experience, that every man who has power is impelled to exercise it.”

Hamilton’s Case: Markets Need Muscle

Hamilton doesn’t waste time arguing for abstract ideals. He is focused on what it takes to be taken seriously in a global economy. To him, that means a uniform commercial policy, a navy to protect trade routes, and a centralized voice to bargain abroad.

“The rights of neutrality will only be respected when they are defended by an adequate power.”

His fear was not that a central government might become too powerful. It was that without one, the U.S. would never become powerful at all.

This was not about building an empire. It was about negotiating on equal terms with Europe, preventing states from undercutting each other, and ensuring that America was not forced to play defense in every deal. He wanted federal power as a guardrail for markets, not a substitute for them.

The Anti-Federalist Response: Power Corrupts, Even in a Port

Anti-Federalists like Brutus and Cato were not anti-commerce. They just did not want a centralized government holding the reins. Brutus predicted that if Congress controlled trade and taxation, it would erode the power of the states and insulate decision-makers from the people.

“The necessary result will be, that the people must be acquainted with very few of their rulers, and will have very little confidence in them.”

Cato pushed harder:

“Power lodged in the hands of rulers...will be abused.”

They worried that economic centralization would become political consolidation. That trade regulation would morph into industrial favoritism. And that the government would stop promoting open markets and start protecting well-connected industries.

Turns out they were not just paranoid. They were reading ahead.

The Modern Sequel: From Shipping Routes to Silicon Chips

Today, Hamilton’s vision still feels essential. Without a federal voice on trade, the U.S. would be a bystander in global markets. But the Anti-Federalist concerns are no longer hypothetical. Much of what they feared is now routine.

When COVID hit, federal coordination allowed the U.S. to manage supply chains and procure emergency supplies. Hamilton would have called it proof of concept. But today, major trade decisions often bypass Congress. Executive orders dictate tariffs. Bureaucratic agencies implement sprawling economic policies without much public debate. And industry groups spend millions lobbying for carve-outs and protective rules.

As the Mercatus Center noted in a 2023 study:

“The problem is not just that tariffs distort trade, but that they create an environment where political access, not competitiveness, determines market outcomes.”

Like everything else in Washington, we are not rewarding the best producers, but the best-connected.

The Tariff Trap

Tariffs were once part of a broader trade strategy. Today, they often feel like economic punishment issued by press release. Presidents from both parties have imposed tariffs without congressional debate, long-term planning, or clear metrics for success. The process looks more like improvisation than policy.

The original idea behind tariffs was to protect emerging industries and retaliate against unfair trade practices. But over the past decade, they have morphed into blunt-force tools, wielded less to defend American workers and more to create the illusion of action.

Between 2018 and 2020, tariffs on Chinese goods surged from an average of 3 percent to over 19 percent. That jump, according to the Peterson Institute for International Economics, raised costs for U.S. businesses and consumers. Prices increased for everything from washing machines to steel. In return, China retaliated, and American farmers needed more than $28 billion in federal bailouts just to stay afloat. That is not an economic strategy, it’s policy whiplash.

Tariffs are taxes. Typically levied without the normal legislative process. They bypass the accountability that comes with public hearings and congressional oversight. And they hit consumers hardest, not foreign governments.

As the Cato Institute noted, “Tariffs harm the very people they claim to help. They raise prices, provoke retaliation, and entrench political favoritism. And they do all of it without improving long-term competitiveness.”

Instead of creating an environment where U.S. businesses innovate and outcompete, tariffs often prop up failing sectors and punish downstream industries. When the government imposes higher costs on imported inputs, domestic manufacturers who rely on those parts are left holding the bag. They are forced to either pass costs on to consumers or cut production altogether.

Free-market advocates from the Mercatus Center have pointed out that protectionism almost always backfires. Rather than making America more self-reliant, it makes it less efficient and more politically captive. Industries stop investing in innovation and start investing in lobbyists.

Hamilton believed in protecting the nation’s commercial strength. However, he never advocated for a federal trade apparatus that would grant the president unilateral control over the entire economic landscape. He wanted power that defended prosperity, not power that substituted for it.

The current tariff model fails both Hamilton and Brutus. It lacks Hamilton’s strategic logic and Brutus’s insistence on constitutional restraint. It punishes competition and rewards proximity to Washington. That’s not unity, but central planning disguised as populism.

Hamilton Was Pro-Market, Not Pro-Control

Let’s not forget that Hamilton was no central planner. He believed in markets. He wanted to nurture American commerce, not by managing it, but by protecting the conditions that allow it to thrive. His version of economic unity was about removing friction between states and projecting strength abroad, not dictating outcomes from Washington.

As he wrote in his Report on Manufactures:

“To cherish and stimulate the activity of the human mind, by multiplying the objects of enterprise, is not among the least considerable of the expedients by which the wealth of a nation may be promoted.”

He wasn’t advocating for micromanagement. He was calling for a national framework that encouraged innovation, diversified the industry, and provided Americans with more opportunities to succeed. It wasn’t about directing the market, but unleashing it.

Hamilton understood that private ambition drives public prosperity. He viewed manufacturing, trade, and invention as engines of national strength, rather than sectors to be centrally directed. In fact, he argued:

“The spirit of enterprise, useful and extensive industry, is essentially connected with the security of property.”

He didn’t want a government that meddled in every aspect of his life. He wanted one that secured property rights, enforced contracts, and maintained an economic environment stable enough for risk-taking and reward.

That vision is a long way from today’s federal trade apparatus. Instead of promoting enterprise, it often substitutes for it. We see industrial policy justified in vague terms, subsidies that favor politically connected firms, and regulatory systems that block new entrants rather than enable them.

Modern trade policy drifts far from Hamilton’s design. It doesn't stimulate the human mind or multiply the objects of enterprise. It narrows them. It replaces 'enterprise’ with ‘entitlement’ and turns competition into a question of influence, not output.

What Hamilton wanted was a launchpad. What we’ve built is a launchpad covered in red tape.

The Last Word

Federalist No. 11 is Hamilton’s attempt to drag America into adulthood. He wants the states to act like a unified entity, not a collection of squabbling siblings. He sees commerce as strategy, trade as leverage, and national coordination as the price of global influence.

He was right. But so were his critics.

Brutus warned that power, once concentrated, rarely stays humble. He feared that economic authority would become political dominance. That the line between promoting commerce and managing it would blur. That people would lose not just influence, but visibility into how decisions are made. Today, trade policy is increasingly shaped by political considerations rather than long-term competitiveness. Congress is on mute. Executive power is on autopilot. And the people who have to pay higher prices have no idea who made the call.

Ronald Reagan saw it coming, too:

“Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

What we need isn’t more centralization or more executive swagger. We need a federal government strong enough to represent American interests abroad but humble enough to stay out of the way at home. One that coordinates where necessary but trusts free people and free markets to drive innovation.

Because here’s the thing: America doesn’t need a Logan Roy at the helm of its economy. It needs a board that works. One that understands markets don’t respond to press conferences, and tariffs don’t make a country stronger just because someone slapped a flag on them.

The real danger isn’t that the kids are fighting. It’s that nobody’s minding the store. And the longer that goes on, the more likely it is that our economic future gets scripted by someone else.

Hamilton brought urgency, Brutus brought caution, and the rest is up to us. Unless, of course, we want to find out what happens when the world’s biggest economy runs like a fourth season of Succession with no writers’ room left.

Just catching up on your latest summary (No. 11). Well done as always. I worry about the corrosive effect of shows like Succession, The Sopranos, Breaking Bad on popular culture. I hope you got a chance to see/read Anne Applebaum’s marvelous speech at the Saltzburg Music Festival (“Democracy and the Music Festival”). Made me think about we need a revamp of civic education in our country. Looking forward to your next column!